To recent grads: Congratulations! Graduating from college is a huge milestone, and your hard work and efforts should be celebrated.

Whether you’re jumping into your first job or embarking on a post-grad trip, it can feel overwhelming to launch into adulthood.

Don’t fret — there are tools to make this transition easier. A significant step into adulthood is opening your first credit card. Perhaps you’re ahead of the game and have been a proud owner of a student card throughout your four years as an undergrad. Or you may be shopping around for your first “adult” credit card.

Either way, we firmly believe the Chase Sapphire Preferred® Card (see rates and fees) should be every graduate’s first credit card.

Here’s why.

High welcome bonus

For a card with a (reasonable) $95 annual fee, you’re looking at 100,000 Ultimate Rewards points after you spend $5,000 on purchases in the first three months of account opening. TPG’s April 2025 valuations put Ultimate Rewards points at 2.05 cents each, meaning this welcome bonus is worth $2,050.

But before you get too excited, ensure you can manage the spending requirement to get the bonus. It works out to about $1,667 in monthly spending for your first three months, which you can easily hit if you’re about to spend a solid chunk on moving expenses and a professional wardrobe for your launch into adulthood.

Still, make sure you don’t charge more than you can afford to pay off, no matter how good the bonus is.

Related: Who’s eligible for the Chase Sapphire Preferred’s bonus?

Daily Newsletter

Reward your inbox with the TPG Daily newsletter

Join over 700,000 readers for breaking news, in-depth guides and exclusive deals from TPG’s experts

Introduction to points and miles

If you want to learn about the world of points and miles, you’ve come to the right place. Here at TPG, we have a plethora of resources to get you started, including our beginners guide and our list of the best first credit cards.

One of the things you’ll see in these guides is that Chase Sapphire Preferred is always at the top of the list. It’s a beginner-friendly card that will ease you into “travel hacking” or learning how to use your credit card rewards to unlock free flights or hotel stays.

There are many redemption options with this card, but you’ll find the most value as a travel rewards card by using your points for travel.

To break it down in simple terms, you have two options for booking travel with this card.

First, you can book through Chase Travel℠ at a 25% points bonus or a rate of 1.25 cents each. For example, 10,000 points translates to a $125 value in travel. You can book a variety of travel on this portal, including flights, hotels, car rentals and cruises.

Once you get comfortable booking travel through the portal, you can dip your toes into transferring your points to loyalty programs.

Chase lets you move your points at a 1:1 rate to its airline and hotel partners, so your 100,000 Ultimate Rewards points can equal 100,000 points in the loyalty program of your choice.

Of course, some partners are better than others, but some of our high-value favorites include Air Canada Aeroplan and World of Hyatt. With these partners, getting much more than 1.25 cents of value per point is possible. We’ve even gotten up to 4.5 cents in value with a business-class ticket on Air France before, so the sky is the limit when it comes to Chase’s transfer partners.

Related: New to travel rewards? Here’s the perfect beginner card combo

Valuable card benefits

The Chase Sapphire Preferred is a popular card, especially among Gen Z, since it comes with many useful partner benefits that can help you save money and reward you at the same time.

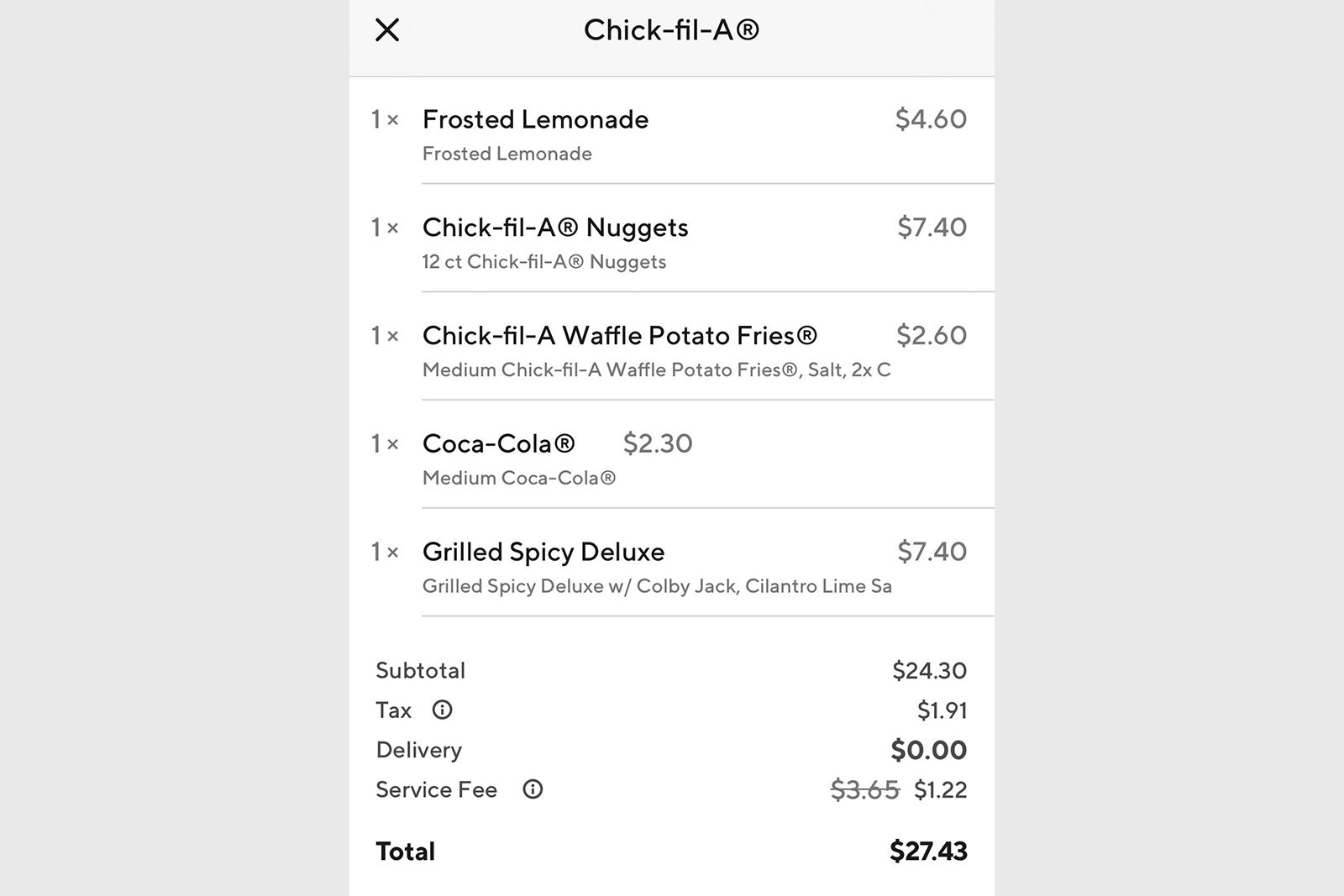

One of the most valuable perks is a complimentary one-year membership to DoorDash DashPass (activate by Dec. 31, 2027). This membership will get you free delivery fees and reduced service fees on eligible orders of $12 or more. This subscription service usually costs $9.99 monthly, so this benefit is valuable enough to justify the card’s $95 annual fee.

You’ll also enjoy 5 points per dollar on Lyft rides (through Sept. 30, 2027). Depending on how often you use Lyft, this is a fantastic way to earn bonus points on this rideshare service.

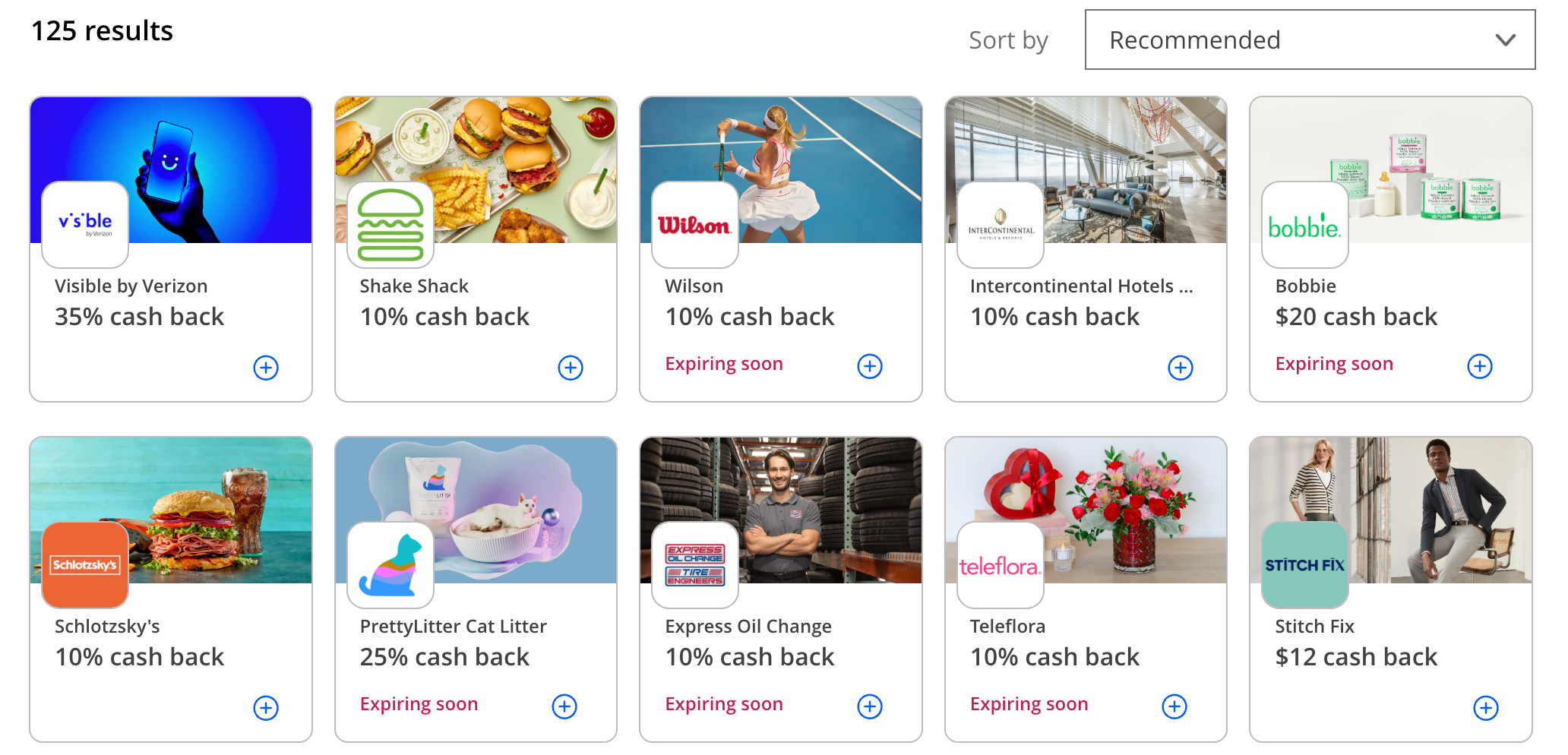

Finally, it’s worth checking the Chase Offers on your card. They’ll update every week or so.

All of these partner offers can help you save money on your everyday purchases.

Related: 8 lesser-known ways your credit card can save you money

Travel and purchase protections

One more reason you’ll love the Sapphire Preferred: No other card with a $95 annual fee comes with as many travel and shopping protections.

Hopefully, you never have to use any of these benefits, but these coverages will give you peace of mind and save you money if an emergency arises:

- Trip cancellation and interruption insurance: Reimburses you up to $10,000 per person (or $20,000 per trip) for your pre-paid, nonrefundable trip expenses due to covered reasons, such as sickness, severe weather and more.

- Lost luggage reimbursement: Covers loss or damage to your luggage by a common carrier (such as an airline) for up to $3,000 per passenger.

- Trip delay reimbursement: Reimburses you up to $500 per ticket to purchase meals or lodging for trip delays of 12 hours or more (or requiring an overnight stay).

- Purchase protection: Covers damage or theft on new purchases, up to $500 per claim and up to $50,000 per account.

- Baggage delay insurance: Reimburses you up to $100 per day (for up to five days) for baggage delays more than six hours to cover the purchase of essential items.

- Extended warranty protection: Extends a U.S. manufacturer’s warranty by an additional year on warranties of three years or less.

- Primary car rental coverage: Covers theft and damage up to the actual cash value of the rental car on bookings of less than 31 consecutive days. Note that most credit cards only offer secondary coverage.

- Travel and emergency assistance: Receive emergency assistance and referrals if you encounter problems while traveling.

For any of these to apply, you must pay for your purchase with your Chase Sapphire Preferred. You can file a claim through chasecardbenefits.com.

Related: How my Chase Sapphire Preferred saved me nearly $250 on a canceled trip

Bottom line

If you’ve just graduated, do yourself a favor and add the Chase Sapphire Preferred to your wallet.

With its fantastic welcome bonus, long-term earning potential and useful perks, you’ll love having this card along for your journey into the adult world.

Apply here: Chase Sapphire Preferred with 100,000 Ultimate Rewards points after you spend $5,000 on purchases in the first three months of account opening.