The Chase Sapphire Preferred® Card (see rates and fees) was my first travel credit card. Since I signed up for it in 2016, I have flown to places like London, Istanbul, Mexico City and Tbilisi, Georgia — all on points. It’s safe to say that my first welcome bonus is long gone.

When I recently transferred my last 36,000 Chase Ultimate Rewards points out of my account to book two nights at the Hyatt Regency Vancouver before an Alaska cruise this summer, I felt rather points-poor.

It would take a while to build my balance back to “business class to Europe” levels — even with generous earning categories like 5 points per dollar spent on all travel purchased through Chase Travel℠, 2 points per dollar spent on all other travel, 3 points per dollar spent on dining, select streaming, online groceries and 1 point per dollar on all other purchases.

But then Chase announced it was raising the bonus on this card to a record-high 100,000 points after spending $5,000 on purchases in the first three months of account opening.

I knew I had to take action.

Related: Don’t cancel: How to downgrade a Chase credit card

my first step

I had already considered signing up for the no-annual fee Chase Freedom Unlimited® (see rates and fees) since I have several high spending categories (vet bills, ugh) that don’t fit into any bonus categories for the current cards in my wallet.

In addition to earning 3% cash back on drugstore purchases and restaurant dining as well as 5% cash back on travel purchased through Chase Travel, the Chase Freedom Unlimited offers 1.5% cash back on all other purchases.

When I heard about the 100,000 bonus, I downgraded my existing Chase Sapphire Preferred to the Freedom Unlimited instead of signing up for a new card. That way, I would be eligible for a new Chase Sapphire Preferred and could earn this historic bonus; unlike Amex cards, it is possible to earn a bonus more than once on Chase Sapphire cards.

Daily Newsletter

Reward your inbox with the TPG Daily newsletter

Join over 700,000 readers for breaking news, in-depth guides and exclusive deals from TPG’s experts

Keep in mind that downgrading to the no-annual-fee Chase Sapphire Card (no longer open to new applications) would still disqualify you.

You’ll need to follow a few crucial rules. Here’s the step-by-step process I followed to downgrade my Chase Sapphire Preferred and sign up for a new one for the chance to earn 100,000 bonus points.

The information for the Chase Sapphire Card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Related: Cards offering welcome bonuses of 100,000 points or more

Check which month your previous bonus hit

According to Chase’s 48-month rule, you can’t earn a bonus on a Chase card if you currently hold that card in your wallet or if you’ve earned a bonus on that card in the last 48 months. (It’s also important to know that Chase won’t let you downgrade a card if you haven’t held it for at least 12 months.)

If you’re wondering, 48 months ago was May 2021, right around the time I was getting the first COVID-19 vaccine.

I’ve only had one Chase Sapphire Preferred account — which I opened in 2016, long before the pandemic — so I knew I was well outside the 48-month rule.

But to double-check, you can scroll back through your statements to see exactly which month your last bonus landed in your account.

Make sure you’re under the 5/24 rule

Next up was the 5/24 rule: In order for Chase to approve me for a new card, I had to check that I hadn’t opened five or more personal credit cards across all banks in the last 24 months.

I was confident I was well under the 5/24 rule, but to double-check, I logged into my Experian account to check my credit history and confirm I had only applied for two new cards in the past two years.

Unfreeze your credit if frozen

If you’ve frozen your credit to prevent anyone else from opening up new credit lines in your name, you must unfreeze your credit before applying for a new credit card.

While in my Experian account, I quickly unfroze my credit so that when I reapplied, Chase could access my credit file. (Chase typically uses Experian to pull credit reports, so I didn’t bother also unfreezing my credit reports at TransUnion and Equifax, the other two credit bureaus.)

Related: How to freeze your credit

Call a Chase agent to downgrade

Once I had checked everything was in order, I called the number on the back of my Chase card and asked the agent to downgrade my Chase Sapphire Preferred to the no-annual-fee Chase Freedom Unlimited.

The first time I called around 7 p.m. on a weeknight, there was a 15-minute wait to talk to an agent. When I called back the next day around noon, an agent answered after a few rings.

The entire call took six minutes. In addition to downgrading me to the Chase Freedom Unlimited, the agent confirmed that my Chase Sapphire Preferred annual fee, which I had just paid in February, would be prorated. Within a day or so, Chase credited $71.28 back to my account.

The waiting game

Within moments, my Chase app showed the Chase Freedom Unlimited card art next to my original card number. Even though everything had transitioned and I no longer had a Chase Sapphire account within the app, I decided to wait until my new Chase Freedom Unlimited card arrived to reapply for a new Chase Sapphire Preferred account.

However, since this is a limited-time offer ending soon, I would act on this as soon as possible.

Signing up again

On Friday, April 25, I decided I had waited long enough and applied for a new Chase Sapphire Preferred. After filling out the new card application, Chase approved me immediately, and my new card number instantly appeared in my Chase app.

Though my new card hasn’t arrived in the mail yet, I was able to add it to my Apple Wallet so I could start charging my subway rides to my new account ASAP and start earning 2 points per dollar spent on travel purchases.

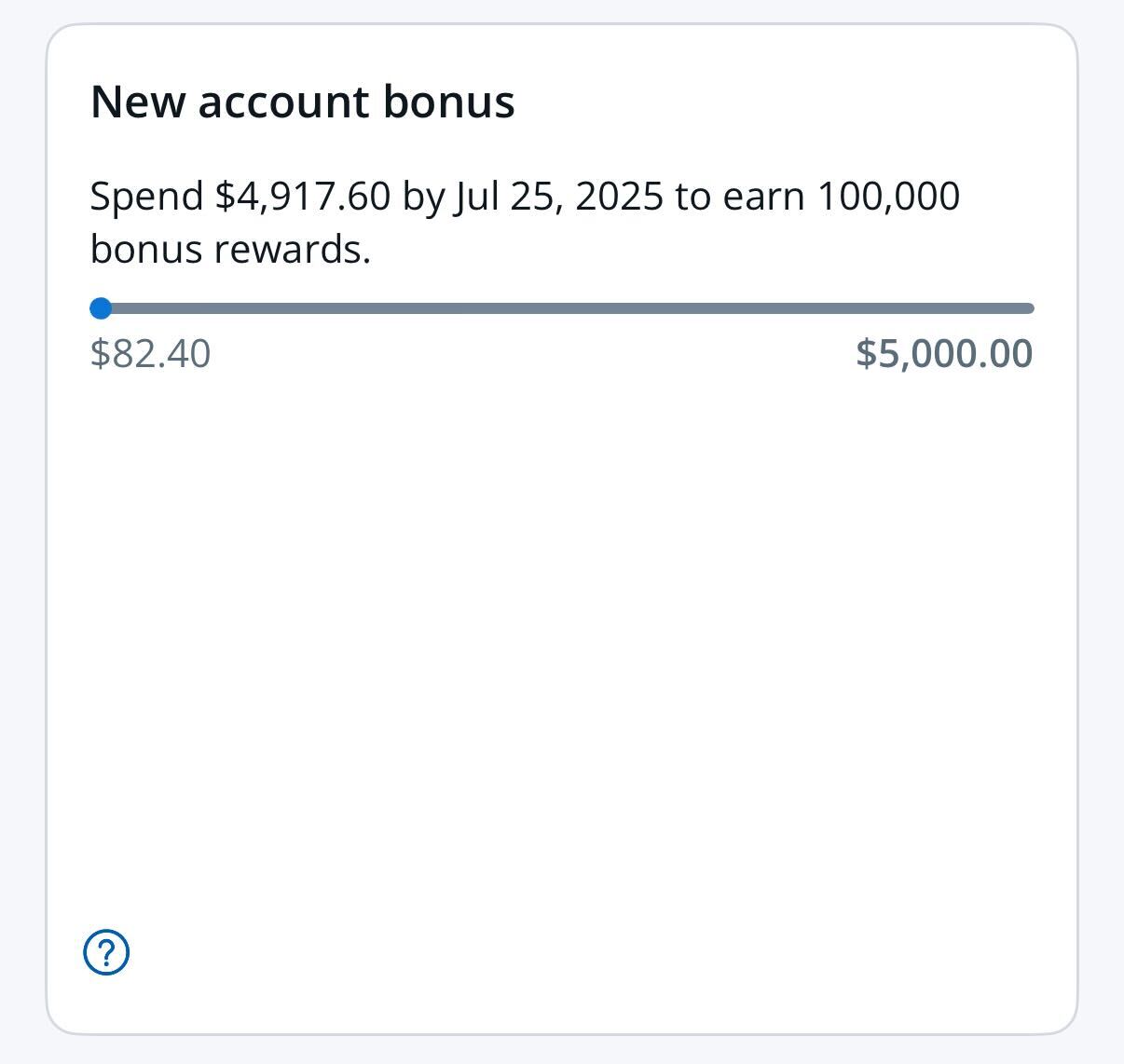

Thanks to the handy tracker Chase added to my account underneath my new Chase Sapphire Preferred, I can see what I’ve spent toward the $5,000 I need to earn the 100,000 point bonus by July 25.

Bottom line

If you’re eager to replenish your Chase Ultimate Rewards balance with another 100,000 points, it could be worth downgrading your Chase Sapphire Preferred to a no-annual-fee card like the Chase Freedom Unlimited so you can reapply for a new Chase Sapphire Preferred account and earn the limited-time bonus.

Just be sure you haven’t earned a Chase Sapphire Preferred bonus within the last 48 months and have signed up for fewer than five new credit cards with any bank in the last 24 months.

Related:

Apply now: Chase Sapphire Preferred